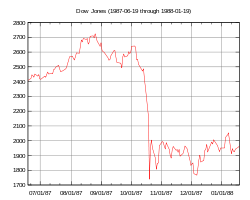

22 years ago today the nation suffered a horrible finanical set-back known as Black Monday. The Dow Jones Industrial Average fell a whopping 22.61% in just one day. Recovery would not be quick or easy. The Dow dropped 508 points to 1738.7.

The drop started in Hong Kong and moved west through the international date line. China was hit the hardest and things from there just raced around the world. According to that great source, Wikipedia:

By the end of October, stock markets in Hong Kong had fallen 45.8%, Australia 41.8%, Spain 31%, the United Kingdom 26.4%, the United States 22.68%, and Canada 22.5%. New Zealand’s market was hit especially hard, falling about 60% from its 1987 peak, and taking several years to recover.[2] (The terms Black Monday and Black Tuesday are also applied to October 28 and 29, 1929, which occurred after Black Thursday on October 24, which started the Stock Market Crash of 1929. In Australia and New Zealand the 1987 crash is also referred to as Black Tuesday because of the timezone difference.)

It is still pretty much a mystery why things happened as they did October 19, 1987. However, financial experts have named leverage as the cause of both crashes, 1987 and 2008. However, in 87 bank leverage was given as the troublemaker and in 2008, derivative leverage was given as the culprit. Insurance derivatives were also mentioned in 1987.

Actually, there are as many theories out there as there are mouths to utter them. There are no conclusions. However, one of the immediate responses was for the federal reserve to pump liquidity into the system. 33 nations met in December to discuss the problem. They predicted that the world economy could be as bad at in the 30’s for the next few years. Obviously, it wasn’t.

However, still fresh on our minds, is the day we watched the Dow drop more than 800 points in one day in what appeared to be a free fall. Overall, in Black Week, as the crash of 2008 has become known as, the Dow lost 1,874 points in ne week. Black Week began October 6, 2008.

So have we survived it? Are things getting back to normal? While it hasn’t been officially named a bull market, stocks have done well since March. It is said that the stock market runs about 6 months ahead of the rest of the economy. That means things should be looking up, right? Right? RIGHT? Somebody say RIGHT back, please!